Overview

The Alabama Enterprise Zone Act, enacted in 1987, provides certain tax incentives to corporations, partnerships and proprietorships that locate or expand within designated Enterprise Zones. In addition to state-level tax incentives, businesses may also receive local tax and non-tax incentives for locating or expanding within a designated Enterprise Zone.

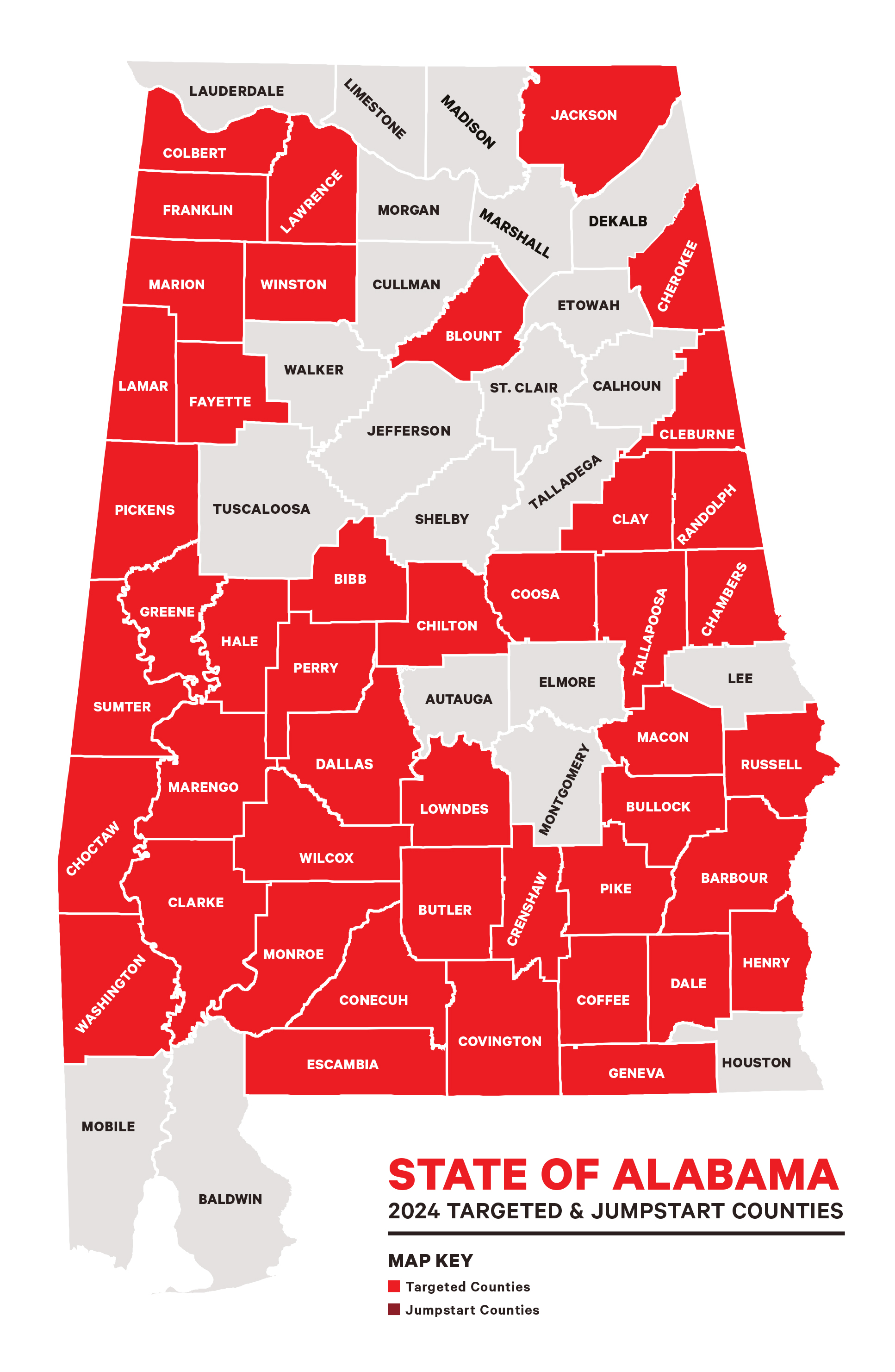

As of October 1, 2016, the definition of an Enterprise Zone changed. The Alabama Jobs Act, #2016-321, states the definition of an Enterprise Zone should be that as described by Section 40-18-376.1(a), Code of Alabama,1975. The Alabama Incentives Modernization Act, Act #2019-392, amended Section 40-18-376.1(a) to describe an Enterprise Zone as any targeted or jumpstart county.

A targeted county means any Alabama county that has a population of 50,000 or less. A jumpstart county means any Alabama county: 1) that does not qualify as a targeted county; 2) that has experienced negative population growth over the last five years; and 3) contains no more than two Opportunity Zones as they existed on June 1, 2019.

Notwithstanding any other agreement or law to the contrary, any eligible businesses that received an approved application from ADECA prior to October 1, 2016, shall continue to receive those exemptions for the period of time specified in those agreements.

As determined by the Act there were 45 Enterprise Zones throughout Alabama in 2021: Barbour, Bibb, Bullock, Butler, Chambers, Cherokee, Chilton, Choctaw, Clarke, Clay, Cleburne, Conecuh, Coosa, Covington, Crenshaw, Dale, Dallas, Escambia, Etowah, Fayette, Franklin, Geneva, Greene, Hale, Henry, Jackson, Lamar, Lawrence, Lowndes, Macon, Marengo, Marion, Monroe, Perry, Pickens, Pike, Randolph, Russell, Sumter, Talladega, Tallapoosa, Walker, Washington, Wilcox, and Winston counties.

Section 5 of the Alabama Enterprise Zone Program offers the following tax incentives:

- Credit based on income tax liability from Enterprise Zone Project Operations

- Credit for new capital investment

- Company may claim a credit of up to $1,000 per new permanent employee for training new permanent employees in new skill areas

Section 11 of the Alabama Enterprise Zone Program offers certain exemptions from the following:

Sales and use tax on purchases of construction-related materials, machinery and equipment used in the zone

Income tax for five years

Business privilege for five years

Alabama Enterprise Zone Procedures Manual

Enterprise Zones 2023 Annual Report

Contact

(334) 242-5384